Hi Ola

What a fantastic question. I have been mulling over this transaction, what data flows and how to account for it the entire evening.

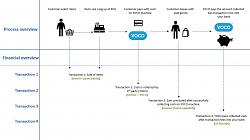

In my view your debtor is YOCO. They collect cash from your cash customer at the point of sale. So when cash is received from YOCO through your cash book receipts it should be allocated to YOCO, not the cash customer he/she already paid and for that reason is not a debtor to start with. I have made a illustration below to show how there are 4 transactions in my view.

I am currently thinking how I can illustrate to you how to capture the transaction quickly in Pastel. I am almost there and will share it asap.

I do think it is very important to see the transactions as they really happen, because this will help sort out your receipting process.

I hope this has assisted. I will post soon post how to use Pastel to quickly post this.

All the best,

Alec Candiotes CA(SA), MCom Taxation

Reply With Quote

Reply With Quote

Did you like this article? Share it with your favourite social network.