Hi

I am at a bit of a cross road concerning the treatment of prepaid tax in terms of deferred tax.

Data:

Prepaid tax R600 000 as at FYE 30 June 2018

Question:

How to account for the deferred tax in the current year’s quarterly financial statements ending 30 September 2018 taking into consideration the prepaid tax carrying value of R600 000 form the prior FY.

Option 1

Include the R600 000 as an asset in the deferred tax balance computation

*correction DT asset should be DT liability

Option 2

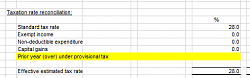

Include the tax value (R600 000 x 28%) in the tax reconciliation note.

Reply With Quote

Reply With Quote

Did you like this article? Share it with your favourite social network.